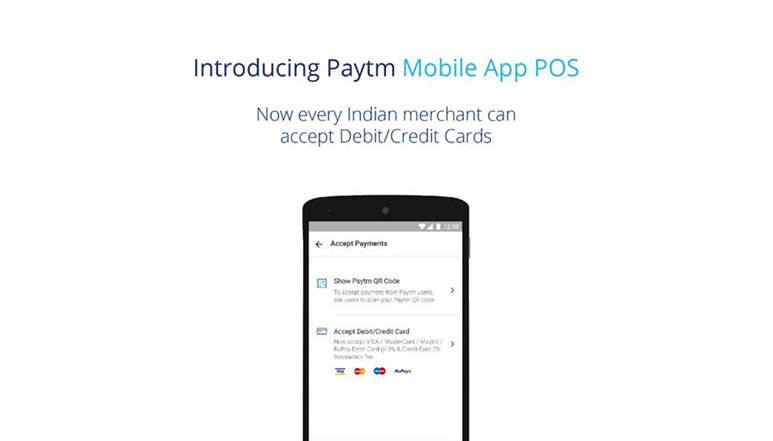

Paytm launches POS app; lets merchants accept debit and credit card payments

The leading mobile wallet company in India, Paytm has launched a new mobile app POS (Point of Sale) that will allow merchants to accept debit as well as credit cards. Basically, it will function as a virtual POS in shops and stores to make a payment, when a POS machine might not be working or is not present.

This latest move from Paytm will especially help small merchants as they will not need to install swipe machines to accept debit or credit cards. According to the company, 1.5 million merchants are currently accepting payments using Paytm. The wallet will charge zero transaction fee for the same till December 31, 2016.

For now, Paytm’s POS is limited to those merchants who have a smartphone, a working Internet connection and the app. After users have entered their card details, Paytm takes them to the bank’s website for the two-factor authentication, and the users will have to enter their OTP in order for the transaction to get verified.

We are on a mission to democratise payments and empower even the smallest merchants to be able to accept credit and debit card payments from their customers. We are very proud that we are able to contribute to the digitisation of our economy. About 10 million Paytm POS apps are expected to be downloaded by this weekend.

– Vijay Shekhar Sharma, Founder & CEO, Paytm.

For accepting all debit and credit cards, merchants will have to self declare themselves as a business on Paytm and give bank account details. The “Accept Payment” tab in the Android app will now allow users to pay with either Paytm Wallet (by scanning QR Code) or by entering their debit/credit card details.

The Paytm app has been updated for Android while the iOS app is still in works.